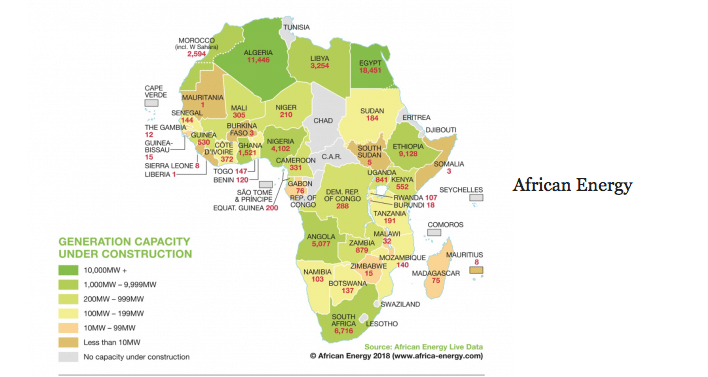

First the good news. Analysis of the 5,300-plus operating, under-construction and planned generation plants now recorded by African Energy Live Data shows installed capacity on the continent will increase by almost 50% from 2018 to 2022, should all announced commercial operations dates be met. The majority of the growth will come from gas and liquid fuel-fired projects, but investment in renewable energy (RE) is increasing quickly.

It is of little surprise that Africa’s largest economies and most populous countries have the largest amount of power generation under construction. With the exception of Ethiopia – which is developing the 6 GW Grand Ethiopia Renaissance Dam (Gerd), East Africa has relatively few megawatts under construction, particularly in troubled areas such as Somalia and South Sudan. However, the region’s ambitious transmission plans point to considerable potential for power trading and, away from established grids, East Africa has proved the crucible in forging innovative off-grid solutions, as it has for other transformative technologies such as mobile banking.

Despite significant gas and hydroelectric power (HEP) resources available in West Africa, of the 6,838 MW under construction in the region, 4,102 MW is taking place in Nigeria. Gambia, Guinea-Bissau, Sierra Leone, Liberia and Burkina Faso are witnessing very little progress and have seen little new capacity come online in the past few years.

South Africa and Angola account for 92% of new generation being built in Southern Africa. In North Africa, Egypt and Algeria also account for 92% of the under construction megawatts, although Morocco and Tunisia also have major renewable energy (RE) and thermal construction projects.

Almost half of the under-construction power generation is located in North Africa (18.5 GW in Egypt and 11.4 GW in Algeria). West, East and Southern Africa have more modest levels of new capacity being built, while only 814 MW is recorded as under construction in Central Africa.

Live Data is an innovative and interactive data platform that allows investors and developers to identify and evaluate power projects across the continent. The platform contains detailed information on more than 5,300 projects and 4,500 organisations as of May 2018, with data points on everything ranging from fuels and technology to shareholders, financing and background information. Live Data’s sophisticated Data Tool aggregates project data to provide insight into the structure and outlook of the power sector at a country, regional and continental level.

Renewables breakthrough

Tumbling prices for solar and wind technologies, coupled with enthusiastic support from programmes such as the World Bank Group’s Scaling Solar and any number of bilateral initiatives from RE enthusiasts such as Germany, have contributed to ever more economies turning to RE solutions. Should the pipeline recorded by Live Data be realised, the share of renewables in the energy mix across Africa will grow from 21% by end-2018 to 25% in 2022.

Broken down regionally, the share of renewables (which includes HEP) in Central Africa will increase from 64.4% to 68.8%, in East Africa from 59% to 65%, in Southern Africa from 25.5% to 28.1%, and in West Africa from 20.4% to 25.9%. RE as a share of the gas-dependent North African electricity supply industries (ESIs) will only moderately increase, from 8.7% in 2018 to 10.2% in 2022.

Jon Marks is editorial director and David Slater is senior project manager at African Energy (www.africa-energy.com).