Month: February 2019

Ethiopia: “Doing Business Intiative”

Ethiopia continues to work towards improving ease of doing business in the country as part of wider economic reforms of the Abiy Ahmed led government.

The move according to the Prime Minister’s office is to help create a conducive environment for businesses to start up and to also have access to finance.

The result of a good business atmosphere and finance the PM said will be a “means of tackling structural problem of unemployment.” Ethiopia, Africa’s second most populous nation suffers a high unemployment rate.

The Premier met with the Ethiopia Investment Commission, EIC, on Tuesday to review progress on performance of the ‘Doing Business Initiative’ government is currently undertaking.

Abiy also stressed that in addressing access to finance problems faced by many startups, a revision of lending practices which allows putting up movable assets as collateral is being put in place.

Ethiopia since Abiy took over in April 2018 has been undergoing a raft of reforms. Under the economic reform sector, Abiy has reiterated his resolve to open up a hitherto government-controlled economic space.

Security watchers have severally said that Ethiopia needs as much economic reform as it does political and human rights reforms.

Security is the other area that Abiy has been tasked to get a grip on in order to consolidate the reform gains chalked in under a year.

Since last year, government disclosed that it was planning to open up state monopoly companies to private investors. The Central Bank also revised some restrictive measures on loans and the general financial system.

The ten key indicators in improving Ethiopia’s ease of doing business rating are focused on:

1. Starting a business

2. Construction permits

3. Registering property

4. Getting electricity

5. Getting credit

6. Paying taxes

7. Trading across borders

8. Resolving insolvency

9. Protecting minority rights

10. Enforcing contracts

“Prime Minister Abiy Ahmed stressed that cutting bureaucratic bottlenecks in these processes will enable focus investment areas of electricity, mining, housing, manufacturing and Small and Medium Enterprises (SME’s) to be effective,” his office added in a tweet.

Credits to Abdur Rahman Alfa Shaban

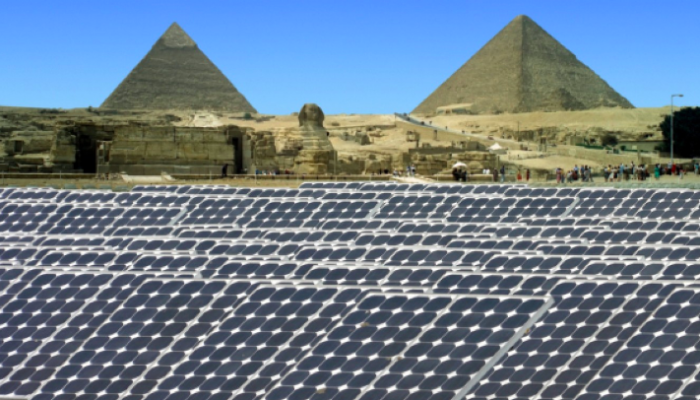

Egypt set for energy revolution with innovative solar strategies

Egypt is undergoing an energy revolution, with the share contributed by renewables set to soar. Innovative solar strategies form a central part.

“The Gulf States have oil; we have solar,” remarks Ahmed Zahran, CEO of the Cairo-based Egyptian solar company – Karm Solar – leaning against the window of a six-story office building in the leafy streets of Cairo’s affluent Zamalek neighbourhood.

Aswan in Upper Egypt ranked the third most sunny place in the world by the World Meteorological Organisation, proves his point.

As Egypt reimagines itself in the wake of the 2011 revolution, the country’s power mix is undergoing a transformation, too. Egypt’s current installed electricity capacity is around 42GW, of which 91% is backed by fossil fuels, the rest renewables. The government, however, envisages a rebalancing, with renewables responsible for 20% by 2022 and 37% by 2035. Solar, alongside hydro and wind, will be the driving force behind this capacity shakeup.

In fact, analysts have argued that if the solar market continues its upward trend, the government projections may turn out to be modest, with the International Renewable Energy Agency predicting that solar alone could contribute as much as 44GW by 2030 – making it the second largest energy source after gas.

Largest solar park

Benban solar park – located just north of Aswan – is set to be the world’s largest solar complex, and after some initial difficulties the project is shaping up as a trailblazer. Comprised of 41 individual solar photovoltaic plants, the park is expected to contribute around 1.6-2.0 GW of power by mid-2019.

In recent years, the Egyptian government has utilised two distinct models to drive investment into solar: feed-in tariffs (FiTs) and competitive tenders. FiTs work on the basis of a set price paid to the producer over a number of years, meaning that the price of the energy is not market-based, and therefore acts like a subsidy.

Benban solar park is the result of a two-round FiT scheme beginning in 2014. After initial interest from a German and Egyptian developer, contracts stalled when the Egyptian government insisted that any arbitration must be held on Egyptian soil. This was amended in the second round of the FiT, and a large consortium of public capital led by the European Bank for Reconstruction and Development (EBRD) stepped in to finance almost all of the projects, which are due to receive $78 per megawatt-hour under a 25-year power-purchase agreement.

In total, 16 development finance institutions (DFIs) are supporting Benban to the tune of $1.8bn, including the International Finance Corporation, the African Development Bank and the Asian Infrastructure Investment Bank.

With the projects underway, the experience is seen as a leading example of crowding in a consortia of development financiers. Furthermore, its developers, faced with logistical challenges and grid constraints, have joined hands to create the Benban Solar Developers Association – soon to become an NGO. Rarely do private solar-developers work effectively together to overcome challenges in the context of competitive emerging markets.

“In many ways Benban is an excellent case study of ways to support large scale renewable infrastructure projects, with a wide body of players and participants coordinating a joint effort,” comments Benjamin Attia, global solar markets analyst with Wood Mackenzie. “The market is now finally booming.”

Going once

With Benban due to come online this year, attention now turns to two competitive tenders: 200MW in the Kom Ombo project in Aswan, and 600MW of capacity in the West of Nile Area. This change in government policy away from FiTs mirrors a global change in strategy to drive investment into solar energy. Some have accused subsidies and government incentives of curbing the European and North American solar markets, arguing that they create unsustainable business models that rely too heavily on government support.

Tenders, otherwise known as auctions, allow governments to define a particular project – including its proposed capacity and sometimes the location – and then invite producers to bid for it. It is the competition associated with the bidding process which results in the market-based price of the energy, and hence the instruments’ growing popularity. The Egyptian Electricity Transmission Company reviewed six bids for the Kom Ombo project, with a Saudi Arabian company outbidding a Spanish developer.

While the jury is still out on the most effective model, Attia explains how competitive tendering can be a useful tool for solar expansion.

“The best way we have seen on a global scale is to create very transparent and regularly cadenced tender schemes,” he says. “Subsidies are no longer necessary for solar projects, particularly in the Middle East, as these are some of the lowest cost projects in the world. When the ticket size is large and the barriers to entry are low – and there are good governance and bankability – these large tenders can draw in big balance sheets from around the world.”

Private sale

Selling energy to government, however, is not the only way to help solar reach its full potential in Egypt. Cairo-based solar company Karm Solar is offering an alternative model: one that produces solar energy and sells it to the private sector.

“What we are doing which is new, even on a global level, is we are able to produce the electricity from central solar stations, and ship that electricity to a distribution network which we own to then sell at the doorstep of shops, offices or houses,” says Ahmed Zahran, founder and CEO. “We are the first company in Egypt to obtain a licence for the generation and sale to the private sector.”

The company has grand production and distribution ambitions, and currently services 15 private clients with a capacity of 73MW. The Egyptian market, Zahran argues, is the most coveted in the region and is ripe for a business model like his, which is motivated by profit rather than incentives. In fact, Karm Solar sell their energy at a cost lower than government prices, he says, and have thus far been almost entirely financed by angel investors.

“We own everything to make sure we are completely in control of the product we are delivering and in control of the costs,” he says. “That’s the only way to be in control of the returns that we want to achieve.”

As the government target of 20% renewables by 2022 looms on the horizon, both the public and private sectors are exploring innovative solar strategies which should convincingly see this target met.

Contribution to Tom Collins (African Business Magazine)

Zimbabwe to launch new Inter-bank forex market

Zimbabwe’s Central Bank Governor, John Mangudya said it is in the process of establishing a new interbank foreign exchange market.

On Wednesday, the Central bank governor said the new forex market will help remove the fixed exchange rate between the US dollar and its quasi-currency.

“The bank is in the process of establishing an immediate interbank foreign exchange market in Zimbabwe to formalize RBTR balances (real-time gross settlement) and bond notes with US dollars and other currencies on the basis of over-the-counter transactions through banks and exchange offices,” he told the press in Harare.

He said this should also help restore price stability in the Southern African nation.

“To this end, prices in Zimbabwe should remain at their current level or start to decline in line with exchange rate stability as current currency balances have not changed’‘, Mangudya added.

When young talents lead innovation and development in Africa

“Solving Africa’s complex challenges will require innovative solutions including those developed by young inventors from the African continent. It is important that we create the necessary environment to discover them.”

Sixteen young African investors weree recently shortlisted as finalists of the Africa Prize for Engineering Innovation awarded by the Royal Academy of Engineering. While the overall winner and three runners up will receive cash funding, all the finalists will receive training and the mentoring they need to scale up their inventions and ultimately translate them into commercial products. The inventions that range from a vertical farm to an online vaccination platform to a device that can convert air into drinking water using solar technology, are bound to deliver practical solutions to Africa’s challenges, including food insecurity.

Indeed, Africa’s recurrent challenges can benefit from many inventions coming off the African continent. Moreover, Africa stands to make more headways when its young people, who represent 60 per cent of its current population, take the lead.

But to pave way for many more inventions from Africa’s young minds, the continent must invest in creating an environment that makes it easy to discoverer these inventors. So how can the African continent pave the way so that many more young inventors are discovered?

Beginning at a young age, when students are attending elementary and high schools, the African education system should make room for young students to be creative, problem solvers and critical thinkers. Currently, the education system, in many countries, including my native country Kenya, and South Africa, is poor quality and mostly focuses on content mastery. I know. The primary and high school I attended in Kenya, for example, focused on teaching theories and materials we needed to pass our national examinations. None of the teachers ever challenged my peers and me to think and create. It was all about mastering the contents and regurgitating them back in the exams. Further, we also lacked other resources including textbooks, libraries, science labs and other resources to help create a conducive environment.

Across Africa, stakeholders investing in education operate under the assumption that passing national examinations gauged by the grades students get is clear evidence that investments in education have paid off. The caveat to this approach is that it does not necessarily prepare students to be inventors or problem solvers and to meaningfully participate in developing our global world.

Moving forward, if Africa wants to reap the dividends of inventions by African students and its young minds, African schools should adopt action-oriented teaching approaches that hone critical thinking skills, creativity and innovation. Africa’s young minds should consistently be challenged to identify local problems, seek out relevant information and resources, and to design authentic plans and solutions to solve the challenges they have identified.

Once discovered, future inventors must be supported through training and mentoring. They must also be funded. Doing so will allow them to fully develop their inventions and translate them into products that offer solutions to the challenges many African citizens face.

The Royal Academy of Engineering prize of mentoring and training support and funding will definitely allow these innovators to translate their inventions into products and to scale up and widely disseminate them. The good news is that, presently, across Africa, there are several programs including The Anzisha Prize, Made in Tony Elumelu Entrepreneurship Programme and the Innovation Prize for Africa that are actively supporting, mentoring and funding young African inventors. This needs to continue.

Moreover, as we aim to pave the way for many African inventors to rise up, while strengthening the overall African innovation ecosystem, we must protect these ideas and ensure that people adhere to intellectual property rights. Before the young inventors’ ideas are shared, they should have the opportunity to trademark and protect them. At the moment, many African countries, research institutions, and universities and other institutions where inventions are born do not understand quite well how to manage intellectual property assets including knowing the available options when they want to protect and translate their inventions into commercial products for national, regional and international markets.

Eventually, when these inventions are translated into products, governments should create market opportunities for their products to ensure that they thrive. For example, government hospitals can buy and install the vertical gardens in hospitals, and these could be used to grow the food to feed patients. The Kenyan Government could use the Chanjo Plus online vaccination platform and roll it out across the country. Further, these inventors must be funded so that they can build industries that further support the production of the products they have created. Such support would further lead to economic empowerment and job creation by the youth and for the youth.

Solving Africa’s complex challenges will require innovative solutions including those developed by young inventors from the African continent. It is important that we create the necessary environment to discover them. Once discovered, we must nurture the inventors, celebrate them, support, and fund their ideas all the way, until they have products and companies to manufacture these products. It is the right thing to do.

Written by Dr Esther Ngumbi, a distinguished post doctoral researcher at the Entomology Department, University of Illinois at Urbana Champaign. She is also a food security fellow with the Aspen Institute New Voices.

Significant progress on path to Africa Continental Free Trade Area

The African Continental Free Area (AfCFTA) is a vital step for boosting intra-African trade. Eighteen countries have ratified it so far, and it is highly expected that 4 more will to do so in the coming months – to meet the 22 ratifications required.

From around 750 CE, the town of Gao in modern-day Mali played a crucial role in the trans-Saharan trade route. The town, which lies on the Niger River, thrived as a major trading centre for gold, copper, salt and slaves travelling north towards modern-day Libya.

The town’s importance and wealth diminished when Portuguese explorers in the 15th century opened up new avenues for trade via sea, before the French colonisation of Mali ended much of the empire’s trade with its northern neighbours.

Today, the trans-Saharan trade routes are mostly used by Berber nomads and a sparse number of trucks carrying fuel and salt. The African Union (AU) and African Development Bank (AfDB) have proposed extending the Trans-Sahara Highway from Algiers in Algeria to Lagos in Nigeria via Tamanrasset.

The project reflects a desire to reignite intra-African trade, which was stymied for many African countries during the colonial era. Trade between African nations stands at 18% of total regional trade, compared to 59% in Asia and 69% in Europe.

The African Continental Free Trade Area (AfCFTA), which has been signed by 49 African countries and could boost African economic output to around $29 trillion by 2050, is a vital step in boosting trade among African countries, according to one of the architects of the agreement, David Luke, coordinator of the African Trade Policy Centre (ATPC) at UNECA.

“The reason intra-African trade is so small is that colonialism forced Africans to export their raw materials outside of the continent to Europe and the US; therefore, much of the trading infrastructure was built with this in mind,” he says. “The AfCFTA is a new paradigm which lets African nations reduce tariffs and non-tariff barriers such as red tape and inconsistent standards for products, which will help boost economic activity across the continent.”

The benefit of the deal is clear. However, to date, only 12 out of the required minimum of 22 member states have ratified the accord. The AU had hoped the agreement would be ratified by the end of 2018. The AfCFTA has six main protocols, including rules on trade in goods, trade in services, rules and procedures on dispute settlement, competition policy, investment and intellectual property rights. All the protocols have to be agreed upon by member states by January 2020 for the full adoption.

While some critics have voiced concerns about the pace of ratification, defenders of the deal believe that significant progress has been made, including Vera Songwe, executive secretary of the UN Economic Commission for Africa (UNECA).

“I believe we are doing very well in terms of ratification of the deal and I’m confident that we will reach the minimum threshold by the middle of 2019 despite the fact that Nigeria is yet to sign up to the agreement,” she says. “There is definitely momentum behind the deal but we need to ensure that we are ready to implement the next part of the strategy the day after it is enacted.”

President Muhammadu Buhari of Nigeria announced that the country would delay signing up to the accord pending further discussions with local trade unions and the business community. The absence of Africa’s largest economy has led some to question the viability of the deal. However, Buhari’s decision is based on a political calculation rather than a lack of faith in the deal, says Gerhard Erasmus, co-founder of the South African-based Trade Law Centre (TRALAC).

“There are very powerful lobby groups who would prefer that Nigeria doesn’t enter into any regional trade arrangements that could challenge their interests,” he says. “And, with the elections coming up next year the incumbent President Muhammadu Buhari has indicated that he is quite sensitive about domestic opposition for this agreement and the official line is that they are consulting the relevant players.”

It seems that it will only be a matter of time before Nigeria – which actually chaired the negotiations that eventually led to the AfCFTA – signs up, with government officials, such as vice president Yemi Osinbajo making positive statements about the deal.

The agreement has, however, received a major boost after South Africa’s parliament ratified it in December. South Africa’s total trade with Africa amounted to R421bn ($30bn) in 2017, with exports amounting R311bn and manufactured goods accounting for 64% of exports to the region. The continent’s second-largest economy and the largest contributor to intra-Africa trade is expected to submit the approved instrument of ratification at the 32nd Ordinary Session of the Assembly of the AU in February 2019.

Reforms

Most African businesses pay an average of 6.9% tax on cross-border transactions and that does not include the additional costs of non-tariff barriers such as excessive bureaucracy, regulatory discrepancies and delays. The agreement calls for member states to cut tariffs on 90% of goods traded. However, removing tariffs is only the first step. Serious reforms will need to be implemented by member nations signed up to the agreement.

“I’m not one of those that believe that suddenly when this agreement is ratified, there will be an explosion of booming inter-African trade,” says Erasmus. “Trade agreements around the world only work when there is a consistent, well-designed effort to improve governance and transparency and, most importantly, there is a private sector producing tradeable goods that other countries want to buy.”

“Therefore, African policymakers need to address nontariff barriers to trade, such as limited industrialisation, weak productivity and poor infrastructure,” he adds.

The success of the agreement hinges on African countries implementing pro-private sector reforms and diversifying their economies. While countries including Tanzania, Kenya, Uganda and South Africa have similar diversification levels to other emerging markets, oil export countries such as Nigeria and Angola have become more dependent on revenues from commodities.

Nevertheless, if endorsed by all the countries of Africa, the AfCFTA would potentially create the largest free-trade area in the world, and leverage Africa’s surging population and a combined GDP of more than $3.4 trillion. However, the agreement is only an enabler. Governments need to create the ideal environment to allow trade to flourish.

Credits to: Taku Dzimwasha (African Business Magazine)

Angola-China Trade Surpasses U.S.$26 Billion

The business volume between Angola and China surpassed last year the USD 26 billion figure, however, the Asian countries authorities predict an increase soon of such value, given the intensity of the bilateral relations.

The information was given last Friday, in Luanda, by the Chinese ambassador to Angola, Cui Aimim, at the end of a meeting with the Speaker of the Angolan National Assembly, Fernando da Piedade Dias dos Santos.

According to the Chinese diplomat, the bilateral co-operation is growing every day, including in the parliamentary domain in which the two states have frequent contacts.

Angola is the main partner of China in the African continent, with the bilateral trade growing rapidly in the past few years. However, the commercial relationship is still too much focussed on crude-oil.

According to Cui Aimim, whose diplomatic mission to this African country is nearing its end, the trend in the coming times will be to diversify the commercial exchanges, with emphasis on agriculture.

“We’ll expand the trade to other goods, such as cassava flour, tropical fruit juices, mineral products besides oil”, emphasised the Chinese diplomat.