Nigeria’s government is seeking a strategic partner to invest up to $300 million and operate the new national airline, Nigeria Air, according to a document seen by Reuters on Thursday.

The West African country’s previous national carrier, Nigeria Airways, was founded in 1958 and wholly owned by the government. It ceased to operate in 2003.

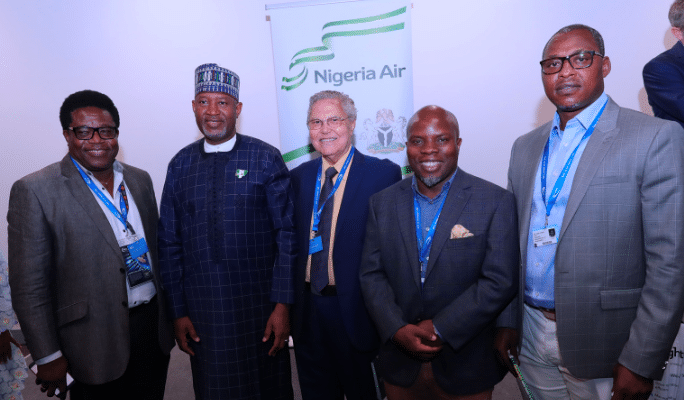

Hadi Sirika, minister of state for avi

ation, on Wednesday said the government would not own more than five percent of the new carrier, called Nigeria Air. He made the comments while providing details of the airline at the Farnborough air show in England.

The government plans to launch the airline in December, making good on President Muhammadu Buhari’s election campaign promise.

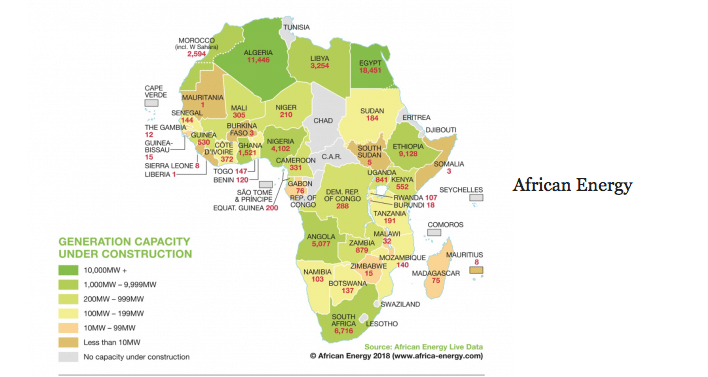

Investing in infrastructure

Decades of neglect and lack of investment have left Nigeria with low-quality infrastructure seen as a hurdle to prosperity. The government has said that upgrading it will require private investment.

“The initial capital is likely to be in the range of $US 150 to 300 million, invested in tranches over time from start-up through the first years of operation,” a government document stated.

It said the government will provide initial capital but did not state the sum or give further details.

The government will “facilitate the process for opening up the capital of the airline to private sector financial investors”, the document stated.

A private operator, sought through a Public Private Partnership (PPP) process, will manage the airline without interference, it said.

Nigeria’s aviation industry

Nigeria Air would serve domestic and international markets and expect to have a fleet of 30 aircraft in five years with hubs in Lagos and Abuja, Nigeria’s two main cities.

British billionaire Richard Branson set up domestic and international carrier Virgin Nigeria in 2000 but pulled out in 2010 in frustration at what he said was interference by politicians and regulators.

The airline he created, which was later rebranded Air Nigeria, closed in 2012 after collapsing under about 35 billion naira of debt which left it unable to pay staff, a former finance director of the company told Reuters at the time.

Nigeria is overhauling its aviation infrastructure and handing over its airports to private managers in order to improve the business environment for the industry sector to attract investment, the document said.

It said current air traffic in Nigeria is around 15 million passengers which is expected to grow at five percent per annum through to 2036.

REUTERS