By Habel Chidawali and Louis Kolumbia

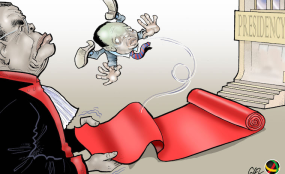

Dodoma/Dar es Salaam — The Minister of State in the President’s Office (Regional Administration and Local Government), Mr George Simbachawene, and deputy minister for Works, Transport and Communications, Mr Edwin Ngonyani, have resigned.

Their resignations came just a few hours after President John Magufuli ordered officials who were implicated by the Committees formed by the Speaker of National Assembly, Mr Job Ndugai, to investigate tanzanite and diamond mining handed over their reports to the Head of State.

Addressing reporters in Dodoma, Mr Simbachawene said he decided to resign after listening to the President’s speech during the reports handover ceremony at State House.

Mr Simbachawene said he was taking political responsibility by stepping down.

“I didn’t sign the contract (the sale of TanzaniteOne to Sky Associates) but I’m stepping down because I was the minister for Energy and Minerals, at the time the contract was signed,” said Mr Simbachawene.

He thanked President Magufuli for having given him the chance to serve Tanzanians.

Mr Simbachawene, however, said he believed his name will be cleared by security organs, which have been ordered to conduct thorough investigations over the matter.

Reached for his reaction, Mr Ngonyani said he was writing a resignation letter in line with the President’s directive to those, who were implicated in the reports.

Speaking to The Citizen, Mr Ngonyani said he held no grudges against President Magufuli.

“Yes, I heard what the President has ordered. I’m currently writing my resignation letter. I support the President’s efforts to make sure that the country’s resources benefit its citizens,” said Mr Ngonyani in a telephone interview.

The committee chaired by Mr Mussa Azzan (Ilala MP on the ticket of CCM), which investigated diamond mining, accused Mr Ngonyani, who was then working with the Ministry of Energy and Minerals, of misleading the government by advising it not to buy Petra Energy and Minerals therefore denying the government a chunk of the $362 million between 2006 and 2016.

Speaking at State House, Dr Magufuli said he had no doubt the reports which exposed a number of irregularities in the diamond and tanzanite extraction businesses were fair.

“Implicated persons may be clean or hardworking, polite and handsome but their names are here in the report. I don’t believe that members of the probe committees hold any malicious intentions towards them,” he said.

“Had the findings of these investigations been politicised, I would have today formed another expert committee to investigate the same. But, I see that they have done their job well,” said President Magufuli.

The Head of State handed over copies of the two probe reports to the heads of the Prevention and Combating of Corruption Bureau (PCCB), the Police Force and the Tanzania People’s Defence Forces (TPDF) and directed them to take legal measures.

He ordered Prime Minister Kassim Majaliwa to convene mineral legal experts including those from the Office of the Attorney General (AG) and the Ministry of Energy and Minerals to initiate a process to amend laws supervising and regulating extraction of diamond and tanzanite in the country.

He ordered engagement of security organs in safeguarding natural resources asking them to prepare a strategic plan on how to secure gemstones. Speaking during the event, Prime Minister Kassim Majaliwa said the probe teams unveiled many loopholes in minerals supervision including theft, embezzlement, corruption and lack of unaccountability. He suggested huge reforms in the minerals sector.

“Also, a new system should be formulated to enable the government benefit from small miners because the report shows that out of 291 licensed miners, only one was operating in Shinyanga denying the country of revenue,” he said.

Earlier on Mr Azzan who chaired the Committee that investigated diamond mining advised the government to revoke a licence issued to Williamson Gold Limited (WGL) that operates in Mwadui, Shinyanga should be revoked and be given to the locals.

For his part, the chairman of the tanzanite probe team, Mr Dotto Biteko, said the country was losing billions of shillings in mineral extraction.

“Over Sh8 trillion is approximated to have been generated from 1998 to 2017. But, records from the Tanzania Revenue Authority (TRA) and the Commissioner of Mineral show that only over Sh400 billion equivalent to 5.2 per cent was collected by the government,” he revealed.

President Magufuli also supported a previous Parliamentary resolution that MPs who have been implicated in many scandals should be disciplined by their parties.

“Don’t hesitate to write letters to political parties about these MPs. I’m the chairman of my political party. We will use our procedures to warn the MPs or ask them to defend themselves according to our party regulations,” said the President.