迫于津巴布韦持续通缩的环境,津巴布韦储蓄银行行长John Mangudya 在今年年初的货币政策声明中可能将实行通胀导向的政策。

英国一流研究机构NKC African Economics (NKC)表示津巴布韦不得不采取措施来应对通货紧缩,因为这对该国的生产部门会造成损害,从而降低经济的增长。

迫于津巴布韦持续通缩的环境,津巴布韦储蓄银行行长John Mangudya 在今年年初的货币政策声明中可能将实行通胀导向的政策。

英国一流研究机构NKC African Economics (NKC)表示津巴布韦不得不采取措施来应对通货紧缩,因为这对该国的生产部门会造成损害,从而降低经济的增长。

ZIMBABWE’S persistent deflationary environment is seen forcing Reserve Bank of Zimbabwe (RBZ) governor John Mangudya to take an inflation-oriented stance in his monetary policy statement that is due early this year.

Leading UK based research unit NKC African Economics (NKC) said the country has no choice but to tackle deflation given that it is detrimental to productive sectors of the economy, consequently reducing economic growth.

John Aglionby in Nairobi

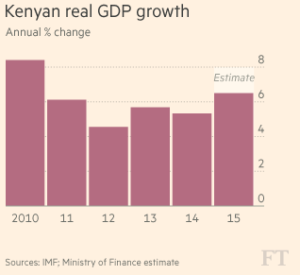

The Kenyan government plans to cut spending by 1 per cent of gross domestic product in the next six months as it seeks to rein in its ballooning budget deficit and create “buffers” to counter emerging market turbulence.

Kenya’s decision to cut its budget mirrors that of South Africa, which is also trying to reduce public sector spending. Ghana, with help from the International Monetary Fund, is seeking to reduce its budget deficit.

In contrast, Nigeria has decided to increase spending in a bid to boost growth while leaders in Uganda and Zambia, which both face elections this year, are also lifting government spending.

根据津巴布韦投资促进署2009-2015的最新数据显示,毛里求斯是津最大的投资国,投资总额达45.6亿美元,中国以28.1亿美元的投资额成为第二大投资国,其中2011年进行了其最大的一次投资,总额10.9亿美元,英属维尔京群岛位居第六,投资额达7亿6054万美元。

数据显示,能源行业投资额将达到4亿美元,制造业5亿美元,采矿也3亿美元。

总额31.6亿美元的170个批准投资项目将会创造13377个工作岗位和大约3000万美元的出口收入。

According to the latest statistics (2009-2015) from the Zimbabwe Investment Authority, Mauritius is the largest source of investment flows accounting for $4,56 billion, China is the second largest source country at $2,81 billion with the most significant amount of $1,09 billion coming through in 2011, while the British Virgin Islands is on sixth at $760,54 million.

According to the figures, $400 million will be invested in the energy sector, manufacturing $500 million and $300 million in the mining sector.

Total investment approved amounted to $3,16 billion from 170 projects. The projects are forecast to create 13 377 jobs and about $30 million in export earnings.

能源和电力发展部长塞缪尔·恩丹格昨日(2016年1月14日)称:”Zesa正在实行它的债务回收战略以进一步遏制用户欠款行为,包括那些电力欠费达10亿美元的政府要员。”

一些政府部员和高级官员一直拖欠电费,而他们家里,庄园里却有着成千上万的资产。如果他们一直拖欠费用,Zesa将停止为他们提供服务。

这项行动将使得一些客户不得不支付高额月款偿还欠债以继续享受电力服务。

虽然Zesa还没有给出确切的电费标准,但有消息来源称电费标准可能由每小时每千瓦9.86美分上调到每小时每千瓦14美分。

非洲南部地区的平均电费标准也是每小时每千瓦14美分。

Zesa is working on a debt recovery strategy to pin consumers, including bigwigs who owe the power utility $1 billion in unpaid bills, Energy and Power Development Minister Dr Samuel Undenge said yesterday.

Some Government Ministers and senior civil servants are not paying their electricity bills, with some owing tens of thousands of dollars at their homes and farms. If they don’t pay for the services, Zesa will come to a stage where it will not be able to deliver that service.

The move would have seen consumers being forced to pay high monthly instalments towards servicing their debts before accessing electricity.

Though Zesa’s proposed tariffs have remained a secret, sources said the utility wanted the price pegged at 14 cents per kilowatt per hour up from 9,86c/Kwh.

The average electricity cost in the Southern African region is 14c/kWh.

2015年3月13日《福布斯》报道

丹格特集团在赞比亚投资的一个价值4亿美元的水泥厂将在三月底之前投入运营,据卢萨卡时报报导。

阿里科•丹格特是非洲最富有的人,也是丹格特集团的所有者,周四在恩多拉市西蒙曼萨开普维普维国际机场的出发口,他对一些记者说,正要试运营的水泥厂位于铜带的马赛蒂区,但因为洪水和尚未得到赞比亚环境管理署(ZEMA)的先决允许而推迟了试运营时间。

一旦开始运营,丹格特水泥厂将达到一百五十万吨的年产量,并且将会创造至少一千个工作机会。

同时,丹格特集团在奇兰嘎建了另外一个水泥厂,奇兰嘎是距赞比亚首都卢萨卡南部20公里的一个小镇。据估计,建造奇兰嘎水泥厂将投入4.2亿美元。

丹格特说,“我们在卢萨卡的工厂运营得不错,而且我们已经获准开采矿产,所以我们很可能在那儿建一个和马赛蒂水泥厂一样的工厂。”

阿里科•丹格特在过去5年里一直是非洲最富有的人。他现有的财富来源于对水泥,糖和面粉的投资,据估计已经达到159亿美元。

MAR 13, 2015 Forbes

A $400 million cement plant in Zambia owned by Dangote Group will be commissioned and commence operations by the end of March, according to a report by the Lusaka Times.

Speaking to a group of Journalists on Thursday at departure at Simon Mwansa Kapwepwe International Airport in Ndola, Aliko Dangote, Africa’s richest man and owner of the Dangote Group, said that the commissioning of the new cement plantwhich is located in Masaiti district in the Copperbelt, had been delayed as a result of flooding and a delay in getting the requisite permits from the Zambia Environmental Management Agency (ZEMA).

Once operational, the Dangote Cement Plant will have a production capacity of 1.5 million tonnes annually and will create at least 1,000 jobs.

Meanwhile, Dangote is constructing another Cement Plant in Chilanga, a small town 20 km south of Zambia’s capital city, Lusaka. The cement plant in Chilanga will cost an estimated $420 million.

“We have made good progress on the plant in Lusaka, we have already got permission to get into the land and start mining, so hopefully the same contractor might move there and build an identical plant with the one in Masaiti,” Dangote said.

Aliko Dangote has been Africa’s richest man for the past 5 years. His current fortune is estimated at $15.9 billion derived from investments in cement, sugar and flour.